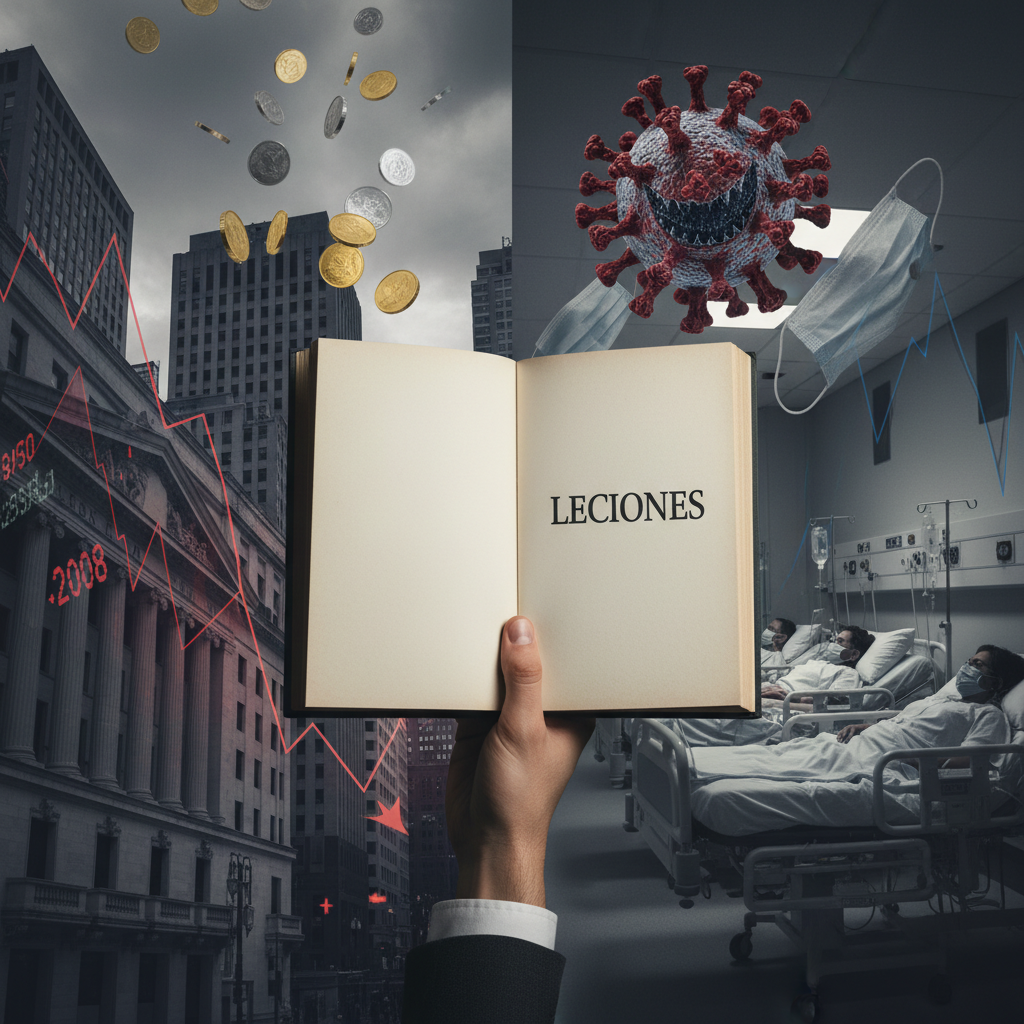

Comparison of the economic crises of 2008 and 2020

The economic crises of 2008 and 2020 mark two different moments with global impacts. Understanding its origins and characteristics allows us to draw lessons for the future.

Both crises caused profound social and economic alterations, but they differ mainly due to their origin: one financial and the other health.

Origin and main characteristics of the 2008 crisis

The 2008 crisis began with the collapse of the subprime mortgage market in the US, leading to a decline in the global financial system.

This episode caused a significant recession, increased unemployment and a collapse in international trade, affecting the real economy.

Governments intervened with bailouts and stimulus, although the recovery was slow and uneven in many countries.

Origin and main characteristics of the 2020 pandemic crisis

In 2020, the crisis arose as a result of the COVID-19 pandemic, an external shock that paralyzed global economic activity.

Unlike 2008, it was not a financial collapse, but rather a direct impact on supply and demand related to health restrictions.

Governments acted with unprecedented measures to sustain the economy, while the recovery depended on health developments.

Impacts and responses to both crises

The crises of 2008 and 2020 caused severe social and economic impacts, including unemployment and increased poverty. Its effects shaped public policies and social attitudes.

Analyzing how these crises were responded to helps understand the importance of rapid measures, coordination and adaptation to mitigate consequences and accelerate recovery.

Shared social and economic consequences

Both crises caused a drastic increase in unemployment and loss of purchasing power, mainly affecting vulnerable groups around the world.

Furthermore, a worsening of social inequalities was observed, which showed the need to protect the most disadvantaged in times of crisis.

These social effects had repercussions on the economy, where falling consumption and investment slowed global growth for several years.

Government measures and economic recovery

Governments implemented stimulus packages and bailouts, protecting key sectors and sustaining employment to avoid a further collapse.

In 2008, the focus was on saving the banking system, while in 2020 the aid was also aimed at alleviating the health and social impact.

The recovery was variable: in the financial crisis, slow and uneven; Faced with the pandemic, it depended on the evolution of the virus and the effectiveness of the vaccines.

Social and technological adaptation to crises

The 2008 crisis prompted families and companies to reduce debt and diversify income to increase their economic resilience in the face of future falls.

For its part, the 2020 crisis accelerated digitalization, promoting teleworking and new forms of social and commercial interaction that persist.

These changes showed that flexibility and technological innovation are essential to address uncertainty and maintain activity.

Lessons learned for economic management

The economic crises of 2008 and 2020 revealed the importance of strengthening financial supervision to avoid devastating systemic risks. Stricter regulation is essential.

Likewise, diversifying the economy allows us to mitigate specific impacts and generates greater stability in the face of different sources of crisis, increasing recovery capacity.

Financial supervision and economic diversification

After 2008, the need for rigorous banking supervision to limit excessive debt and avoid risky assets that threaten stability became clear.

Furthermore, diversifying sectors and sources of income reduces vulnerability to sectoral crises, protecting wealth and improving overall economic resilience.

Together, these measures strengthen the financial system and reduce the likelihood of collapses that could trigger deep and prolonged crises.

Preparation for external shocks and resilience

The 2020 pandemic highlighted the need to prepare for unexpected external impacts that abruptly affect the large-scale economy.

Building resilience involves adopting strategies that allow you to adapt and recover quickly, minimizing social and economic damage in times of crisis.

This preparation must include economic reserves, early warning systems, and the ability to implement rapid and effective measures in the event of different types of shocks.

Importance of coordination and anticipation

International coordination is essential to confront global crises that do not respect political borders. Cooperation allows for faster and more effective responses.

Furthermore, anticipating possible crises strengthens economic and social preparation, reducing vulnerabilities and facilitating the implementation of preventive measures.

International regulation and supervision

The 2008 crisis highlighted the need for coordinated financial supervision that transcends borders to avoid infections and systemic collapses.

International organizations must establish common regulatory frameworks to monitor emerging risks and ensure stability in global markets.

More rigid and harmonized regulation protects the most vulnerable countries and fosters trust between diverse economic actors.

Agility and response to systemic threats

The 2020 pandemic demonstrated that crises can arise suddenly and require rapid and flexible responses to systemic threats affecting multiple sectors.

Economic systems must be able to adapt agilely, implementing technologies and strategies that mitigate the impact and facilitate recovery.

Strategic anticipation includes everything from health plans to mechanisms to sustain economic activity in critical scenarios.